A well-crafted budget can help you save money, pay down debt, and achieve other financial goals. Preparing a monthly budget is essential for anyone looking to gain more control of their personal finances. For that reason, you won’t have a true representation of your financial health and you could be missing valuable information that can help you make better-informed decisions. Without a budget template, minor or variable expenses may fall through the cracks and not be accounted for.

MONTHLY EXPENSES BREAKDOWN PROFESSIONAL

By tracking your expenses and income in a professional template, it’s a lot easier to keep track of minor details.

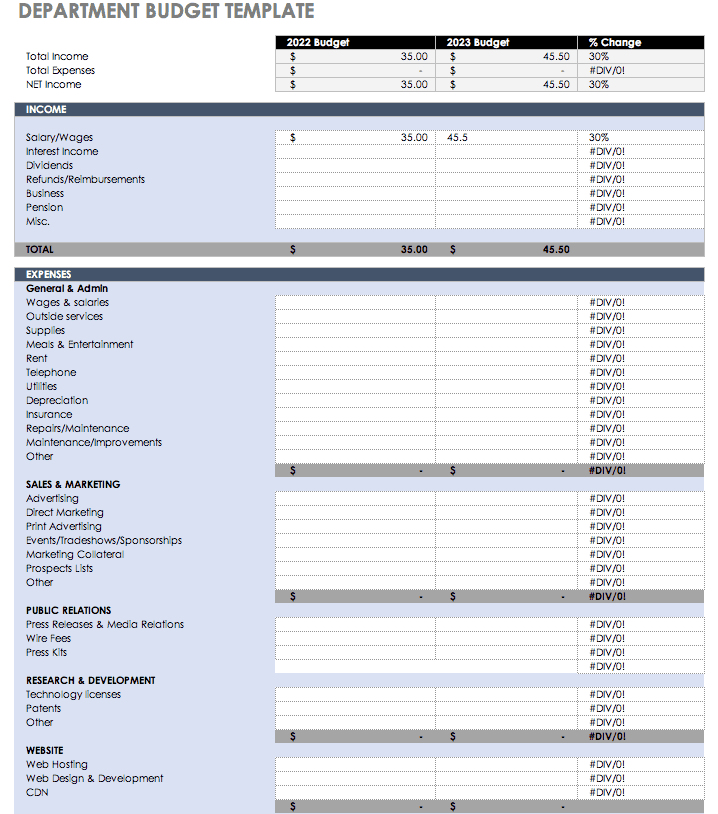

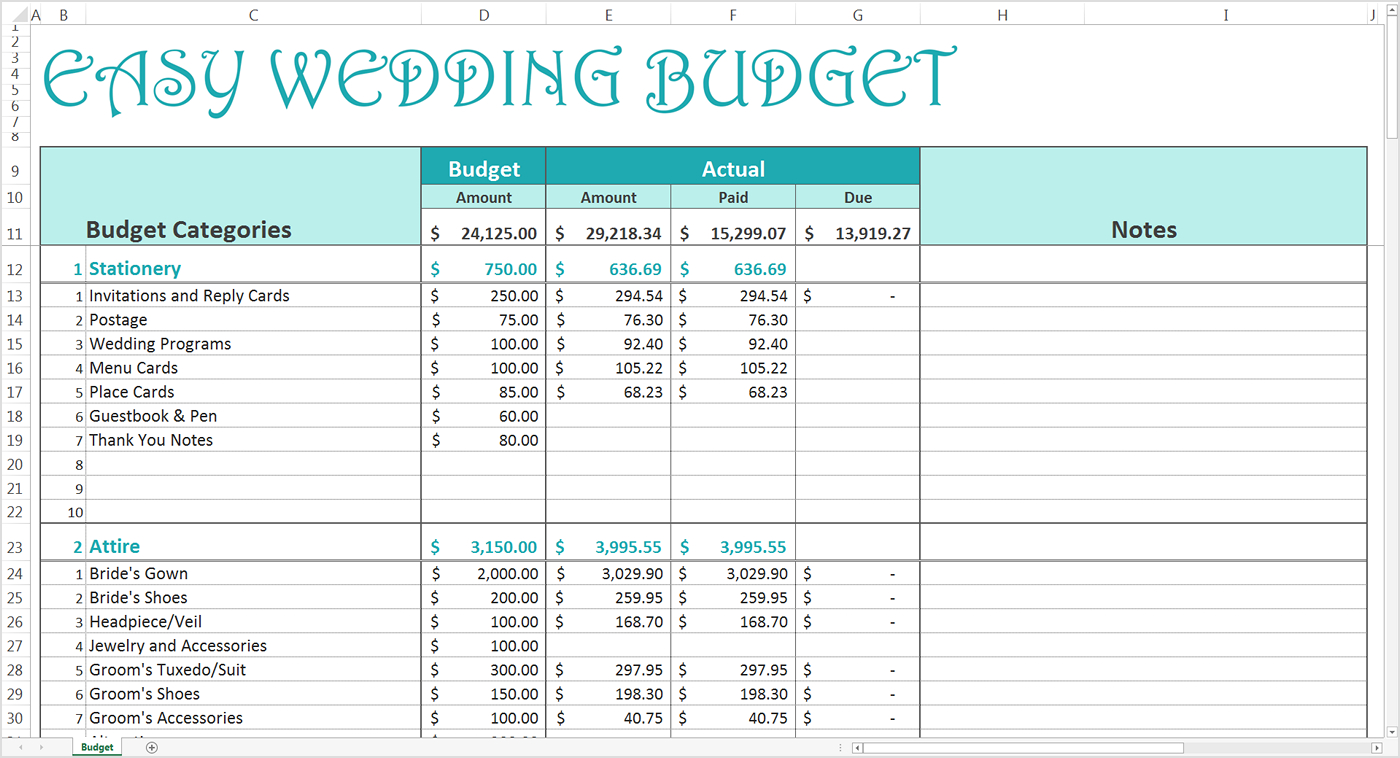

Helps you track minor detailsĪ budget is only as good as the data it contains. Now that you’ve got a handle on what a budget template is, let’s look at a few of the benefits of using one. Expenses: Food, transportation, medical, utility, debt, pet, and variable expensesīudget templates also add these individual amounts together, showing you what you’re spending and earning in each individual category.ĭownload to excel Why use a personal monthly budget template?.Income: Wages, tips, capital gains, bonuses.Generally, a personal budget template splits your income and expenses into categories like: In other words, a done-for-you template takes the guesswork out of creating a budget. While you can create your own budget planner, using a ready-made template guarantees that you’re not neglecting important financial information. And most importantly, a monthly budgeting template provides a bird’s eye view of your current financial situation.

It lets you compare your budgeted expenses and income versus your actual expenses and income. Get the template What is a personal monthly budget template?Ī personal monthly budget template helps you plan your spending. We’ll also take a look at ’s personal monthly budget template. In this article, we’ll introduce you to a variety of monthly budgeting spreadsheets, worksheets, and planners that can help you in your budgeting journey. Much of the anxiety around budgeting your money can be reduced with a little proactivity, persistence, and the right budgeting template.

0 kommentar(er)

0 kommentar(er)